Exactly How Offshore Firm Formations Job: A Step-by-Step Overview for Entrepreneurs

Offshore firm formations can provide substantial advantages for business owners seeking tax obligation optimization and asset security. The process includes several vital actions, beginning with cautious territory selection and detailed documentation preparation. Involving expert services is crucial for conformity. Nevertheless, many overlook the recurring obligations that comply with first registration. Recognizing these complexities can make a significant difference in leveraging offshore chances effectively. The following steps are important for long-term success.

Comprehending Offshore Business: What They Are and Why They Matter

Although the concept of overseas firms might seem complicated, comprehending their fundamental nature and importance is crucial for both individuals and organizations seeking to maximize their monetary methods. Offshore companies are entities registered outside the person's nation of residence, usually in territories that provide beneficial regulatory settings. These services can offer various benefits, such as tax optimization, possession defense, and boosted privacy.

For business owners, establishing an offshore company can help with international profession, reduce operational expenses, and broaden market reach. Furthermore, offshore companies commonly enable structured conformity with international policies. Individuals might additionally use overseas structures to secure personal assets from financial or political instability in their home nations. Eventually, the allure of overseas companies exists in their capacity to boost monetary flexibility and offer strategic advantages in a significantly interconnected worldwide economic situation - Offshore Company Formations. Comprehending their operational framework and benefits is vital for making informed choices

Picking the Right Territory for Your Offshore Firm

Picking the appropriate territory for an overseas company is vital for optimizing tax advantages and guaranteeing conformity with neighborhood guidelines. Various territories use differing tax rewards and regulatory environments that can considerably affect business operations. A careful evaluation of these aspects is essential for notified decision-making.

Tax Obligation Advantages Summary

When thinking about the establishment of an overseas firm, recognizing the tax obligation advantages connected with different jurisdictions is vital. Different locations offer special advantages, such as reduced or no company tax prices, which can substantially boost profitability. Some territories supply tax motivations for particular types of companies, bring in business owners looking for reduced tax obligations. Additionally, particular nations enforce beneficial tax treaties that lessen double tax on worldwide revenue, making certain that services preserve more revenues. The selection of territory additionally impacts value-added tax obligation (VAT) and various other regional taxes. Business owners must examine these variables very carefully to select a location that aligns with their business objectives, optimizing tax performance while remaining compliant with global policies.

Regulatory Environment Considerations

Selecting the appropriate jurisdiction for an overseas firm calls for a detailed understanding of the governing setting, as different countries enforce varying levels of conformity and governance. Entrepreneurs must examine factors such as lawful frameworks, tax obligation guidelines, and reporting commitments. Jurisdictions like the British Virgin Islands and Cayman Islands are typically preferred for their business-friendly regulations and minimal reporting requirements. Conversely, some countries may enforce rigorous regulations that might make complex procedures and boost costs. Additionally, the political stability and credibility of a jurisdiction can affect the lasting feasibility of the offshore firm. Subsequently, mindful factor to consider of these governing facets is important to guarantee that the chosen jurisdiction lines up with the company's critical objectives and operational demands.

Preparing the Required Paperwork

Preparing the required paperwork is a crucial step in the overseas firm development procedure. Entrepreneurs have to collect different legal and recognition papers to promote their business's establishment in a foreign territory. Typically, this includes a detailed service strategy describing the business's goals and functional strategies. In addition, individual recognition records, such as passports or motorist's licenses, are needed from the company's investors and supervisors.

In a lot of cases, evidence of address, like energy bills or bank declarations, is needed to confirm the identities of the entailed events. Particular types dictated by the jurisdiction, consisting of application kinds for registration, must be finished accurately. Some territories might likewise call for a statement of the nature of business tasks and compliance with neighborhood policies. Extensively preparing these files ensures a smoother registration process and helps mitigate prospective hold-ups or issues, ultimately establishing a strong foundation for the offshore entity.

Involving Professional Providers for Offshore Formation

Involving expert services in overseas development can greatly boost the effectiveness and efficiency of the process. Business owners usually deal with intricacies that can be frustrating, making professional assistance indispensable. Professional firms focusing on overseas formations provide a wealth of understanding regarding jurisdiction selection, business structure, and local market conditions.

These experts can aid in composing important documents, making certain accuracy and compliance with details needs. They likewise assist improve communication with local authorities, decreasing the probability of misunderstandings or hold-ups. Furthermore, professional solutions can provide insights into calculated benefits, such as tax obligation benefits and possession defense, customized to the business owner's specific requirements.

Navigating Regulatory Compliance and Legal Requirements

Comprehending the governing landscape is important for entrepreneurs starting on offshore business developments. Conformity with international policies and regional regulations is essential to prevent lawful mistakes. Each jurisdiction has particular demands concerning firm registration, reporting, and taxation, which need to be extensively investigated.

Business owners ought to familiarize themselves with the regulations governing company framework, possession, and operational methods in the chosen offshore location. In addition, anti-money laundering (AML) and understand your consumer (KYC) regulations often apply, requiring correct documents and verification procedures.

Involving with legal professionals that concentrate on overseas solutions can give invaluable advice on navigating through these intricacies. Making certain compliance not just protects the business from prospective lawful issues but likewise enhances integrity with companions, financiers, and regulatory authorities. By sticking to the proposed legal structures, business owners can properly leverage the advantages of overseas company formations while minimizing risks related to non-compliance.

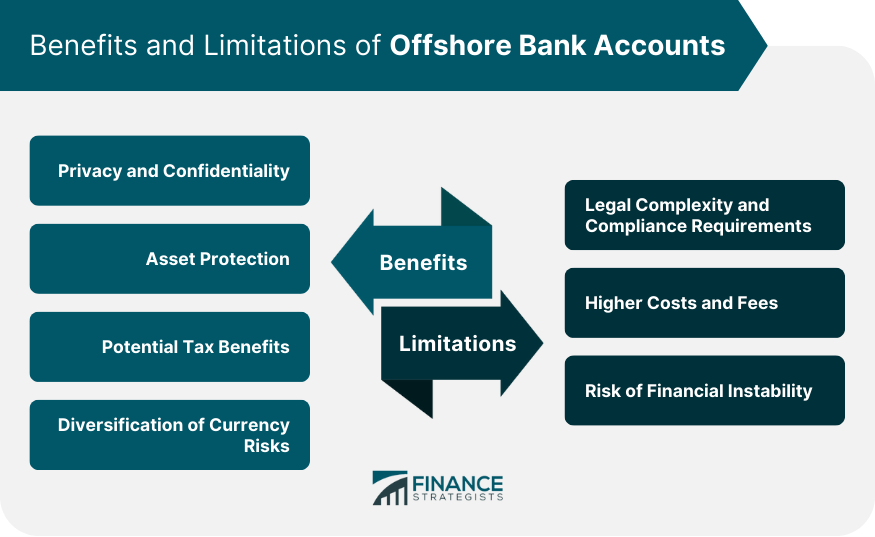

Setting Up Financial and Financial Accounts

Once an appropriate financial institution is identified, business owners typically require to prepare and send various papers, including evidence of identity, company registration papers, and a summary of the designated business tasks. (Offshore Company Formations)

Some financial institutions might also need a minimal deposit to open up an account. Entrepreneurs must be prepared to answer questions relating to the resource of funds and organization procedures. By extensively recognizing the banking landscape and following the bank's needs, business owners can safeguard their offshore firm has seamless access to essential economic solutions for efficient procedure.

Preserving Your Offshore Firm: Ongoing Responsibilities and Ideal Practices

Maintaining an overseas company entails a number of ongoing duties that are essential for conformity and functional integrity. Secret elements include sticking to annual conformity needs, maintaining precise financial records, and understanding tax obligation responsibilities. These elements are necessary for making certain the business's longevity and legal standing in its jurisdiction.

Annual Compliance Requirements

While developing an offshore company offers many benefits, it likewise entails recurring look what i found obligations that can not be neglected. Yearly compliance demands vary by territory yet generally include sending economic statements and yearly returns to neighborhood authorities. Business must additionally pay annual fees, which can consist of enrollment renewals and tax obligations, relying on the area. Additionally, numerous territories require maintaining an authorized office and a neighborhood rep. Failing my website to follow these policies can lead to penalties, including fines and even dissolution of the business. Entrepreneurs should additionally be aware of any type of changes in neighborhood legislations that may impact their compliance obligations. Staying informed and organized is vital for maintaining the benefits of an overseas business while fulfilling lawful duties efficiently.

Preserving Financial Records

Conformity with yearly needs is just part of the continuous obligations related to overseas business administration. Preserving accurate financial records is essential for ensuring openness and responsibility. Business owners must systematically document all transactions, consisting of revenue, expenditures, and assets. This method not only help in inner decision-making but also prepares the firm for potential audits from regulatory authorities.

Consistently upgrading monetary statements, such as profit and loss accounts and equilibrium sheets, is vital for tracking the firm's monetary health and wellness. Using bookkeeping software can enhance this process, making it easier to keep and produce reports compliance. In addition, entrepreneurs ought to think about seeking expert bookkeeping solutions to ensure adherence to local regulations and ideal techniques, thereby safeguarding the stability and online reputation of their offshore procedures.

Tax Commitments Introduction

Steering via the complexities of tax commitments is essential for the effective monitoring of an overseas business. Entrepreneurs should understand the tax obligation laws of both their home country and the territory where the overseas entity is developed. Conformity with neighborhood tax regulations is essential, as failing to stick can cause penalties or legal concerns. Consistently submitting required income tax return, even when no tax obligation may be owed, is frequently required. Additionally, maintaining precise and updated financial documents is important for demonstrating compliance. Inquiring from tax specialists acquainted with international tax obligation legislation can help navigate these commitments efficiently. By implementing finest techniques, business owners can guarantee that their offshore operations stay lawfully certified and monetarily sensible.

Often Asked Questions

For how long Does the Offshore Firm Development Process Commonly Take?

The offshore company formation process usually varies from a couple of days to several weeks. Variables affecting the timeline include jurisdiction, paperwork demands, and responsiveness of economic and legal institutions associated with the arrangement.

What Are the Expenses Related To Preserving an Offshore Business?

The prices related to preserving an offshore business can differ commonly. They generally consist of yearly registration costs, compliance costs, accounting solutions, and feasible legal fees, relying on the territory and specific service activities entailed.

Can I Open a Personal Financial Institution Account for My Offshore Business?

Opening a personal financial institution account for an offshore firm is normally not allowed. Offshore accounts have to be service accounts, reflecting the firm's activities, thereby abiding by policies and making certain appropriate economic administration and lawful accountability.

Exist Constraints on Foreign Ownership of Offshore Business?

What Takes place if I Fail to Abide By Offshore Regulations?

Failing to follow offshore regulations can result in serious penalties, consisting of significant penalties, loss of organization licenses, and possible criminal costs. Additionally, non-compliance may lead to reputational damages and difficulties in future company procedures.

Offshore companies are entities signed up outside the individual's country of home, commonly in jurisdictions that supply favorable governing atmospheres. Selecting the ideal jurisdiction for an offshore firm is vital for maximizing tax obligation advantages and guaranteeing conformity with local guidelines. When taking into consideration the facility of an offshore firm, understanding the tax advantages connected with different territories is essential. Selecting the right jurisdiction for an overseas company needs an extensive understanding of the check my blog regulatory environment, as different nations impose varying degrees of conformity and governance. Additionally, the political stability and online reputation of a jurisdiction can affect the long-lasting stability of the overseas company.